ASHA Fund provides a unique opportunity of investing in the burgeoning Indian Real Estate. ASHA is ArthVeda’s fourth Real Estate Fund with a focus on Housing for Low Income Groups (LIG) in outskirts of Metros, Tier 1 / 2 / 3 cities. The fund replicates the proven investment strategy of ArthVeda’s Middle Income Housing Fund, STAR Fund, to Low Income Housing (LIH) with much stringent investment norms.

AAA Initiative

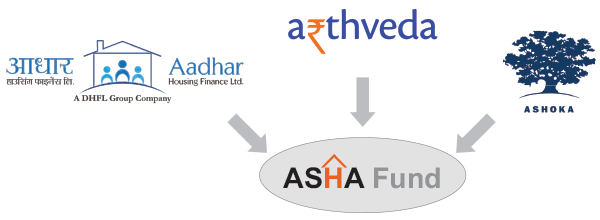

ASHA is a unique fund managed by ArthVeda in conjunction and in collaboration with:

- Aadhar Housing Finance Limited (AHFL) – a JV between DHFL and IFC, Washington. AHFL focuses exclusively on providing housing finance to low income households.

- Dewan Housing Finance Corporation Limited (DHFL) – 3rd largest mortgage finance company in India. DHFL focuses on providing mortgage/construction finance to Low / Middle Income Households.

- Ashoka Foundation, an NGO operating in 80 countries, enables housing for Low Income Groups (LIG) and Economically Weaker Sections (EWS) through its “Housing for All” initiative

Value Investing

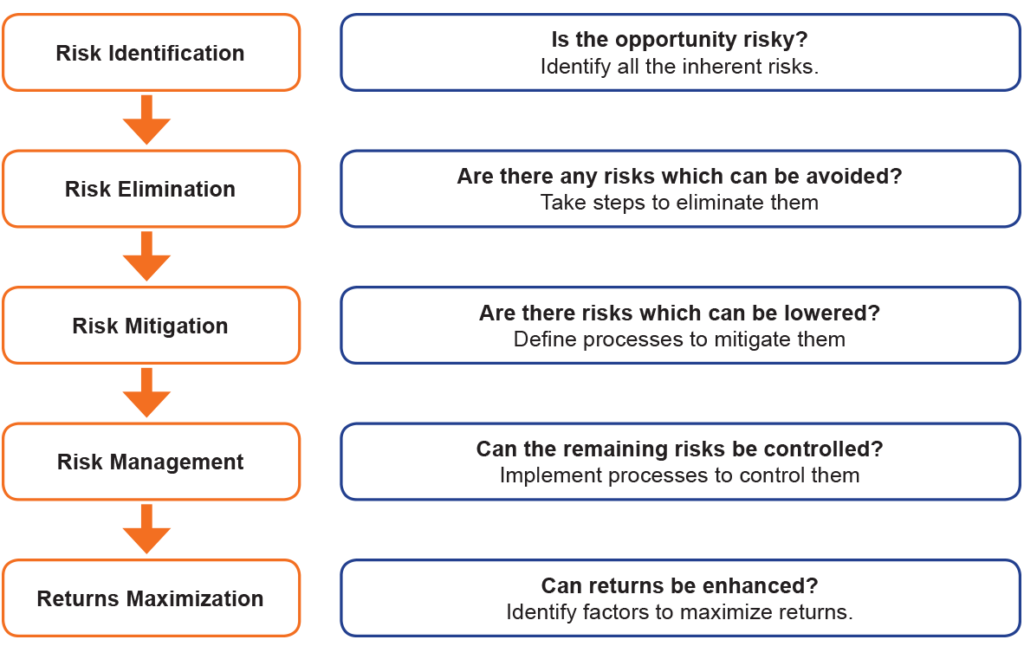

ASHA follows the tenets of value investing to deliver superior risk adjusted returns. Investment destinations have been carefully screened based on a rigorous secondary research and interactions with industry participants. Investment parameters have been defined based a thorough on-ground research while incorporating ArthVeda’s investment expertise in the Middle Income Housing Investments. All investments are subject to a very rigorous due-diligence process, which provides a 360-degree on all aspects of the target project.

The fund will primarily invest in quick-turnaround residential projects for Low Income Groups (LIG) and may re-invest the capitals and returns during the term of the Fund.

ASHA is registered as AIF CAT – II Fund with SEBI.

Investment Objective: To generate superior risk adjusted returns by investing in quick-turnaround residential projects for LIG. Fund will participate with the developer thorough-out the life cycle of the project right from the conception stage.

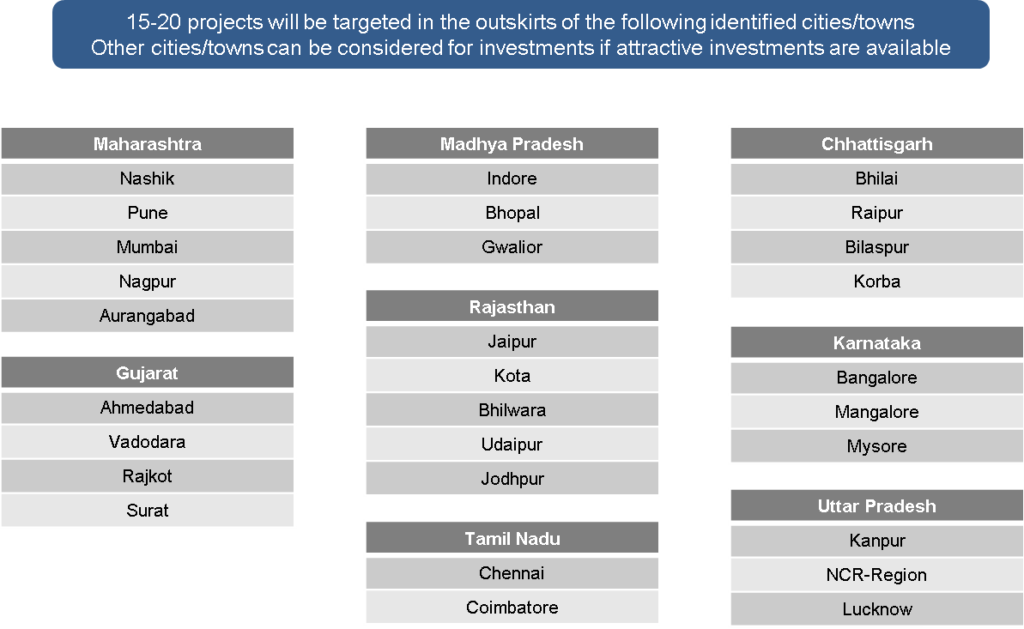

Potential Investment Locations:

Target Fund Size: Rs. 100 cr + Rs. 50 cr (green-shoe option)

Fund Life: 5 years (option of extension of two terms of one year each), after complete drawdown

Target Gross Returns: 25% IRR